Renewable Energy Tax Credit Platform

The comprehensive solution for managing tax credits from generation through validation to transfer—streamlining compliance and maximizing value.

Trusted by leading organizations

Tailored Solutions for Every Stakeholder

Our platform addresses the specific needs of each participant in the tax credit lifecycle

Credit Buyers & Tax Teams

Challenges

- •Finding reliable, compliant tax credits with proper documentation

- •Consuming resources to verify compliance on each purchase

- •Potential recapture risk if credits are challenged by the IRS

Solutions

- ✓5-point verification framework ensures comprehensive compliance

- ✓AI-assisted document review reduces due diligence time

- ✓Comprehensive documentation provides recapture protection

Credit Creators & Developers

Challenges

- •Organizing hundreds of documents across dozens of categories

- •Sharing documents and meeting due diligence requests

- •Ensuring all adders are properly documented to maximize value

Solutions

- ✓AI system automatically classifies and organizes documents

- ✓Access to curated network of qualified buyers

- ✓Structured frameworks to maximize credit value

Brokers & Attorneys

Challenges

- •Managing documents across multiple platforms for each client

- •Thorough due diligence while maintaining deal momentum

- •Building client confidence with efficient, transparent processes

Solutions

- ✓Dedicated broker portal with comprehensive organization

- ✓AI-powered tools for rapid document review and verification

- ✓Structured workflows that build client satisfaction

Powerful Features for Every Step

Click any feature to learn more about how Deal Star streamlines your tax credit workflow

Generate

Streamlined project creation with guided workflows

Match

Intelligent buyer profile management and matching

Transfer

Complete IRS registration tracking and compliance

Structure

Centralized project participant coordination

Verification

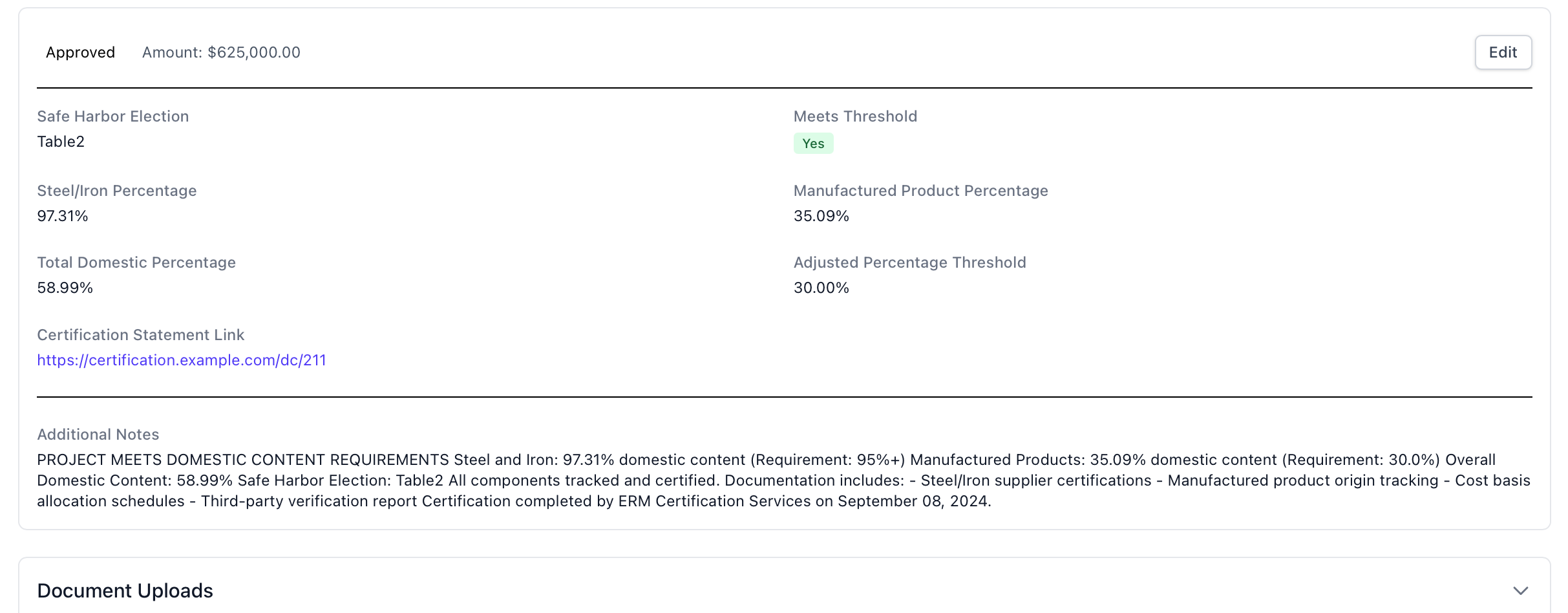

Domestic content certification and tracking

Insure

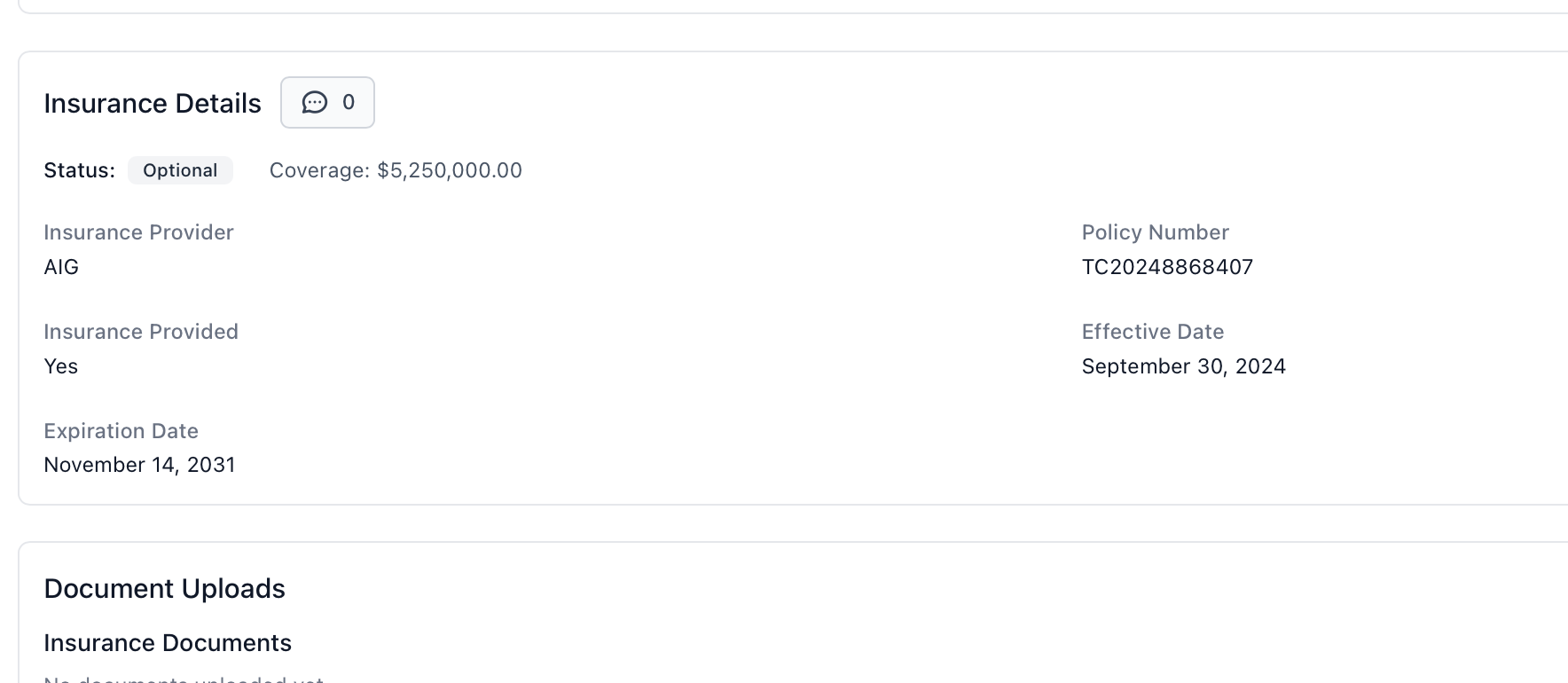

Insurance policies and risk management tracking

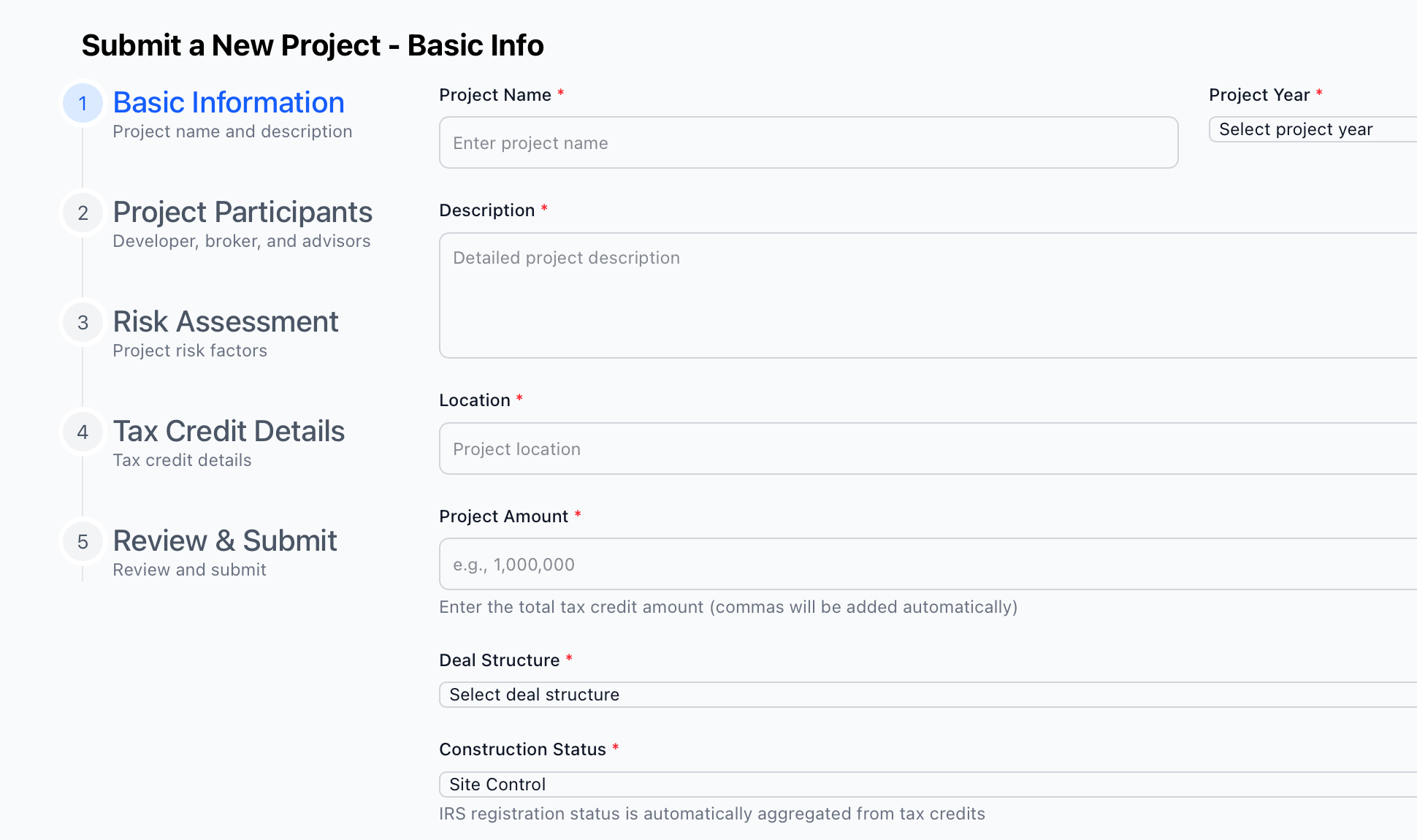

Streamlined Project Creation

Guided step-by-step project setup

Capture all essential information with our intuitive workflow

Automatic data validation

Ensure accuracy with built-in validation checks

Tax credit calculation tools

Automatically calculate eligible tax credits

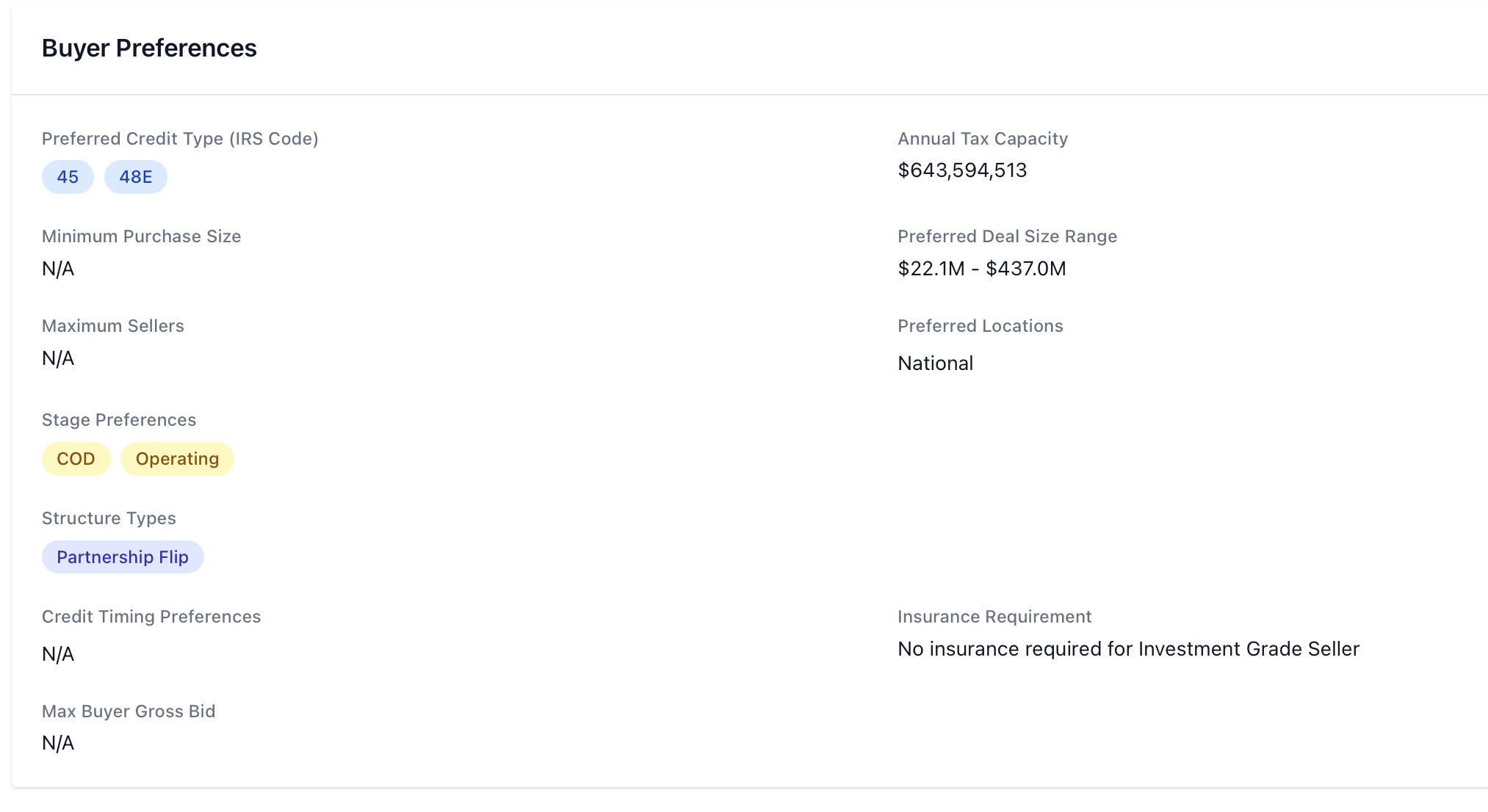

Buyer Profile Management

Intelligent buyer-project matching

Automatically match projects with qualified buyers

Customizable buyer preferences

Define credit types, deal sizes, and locations

Automated notifications

Get alerted when new matches are found

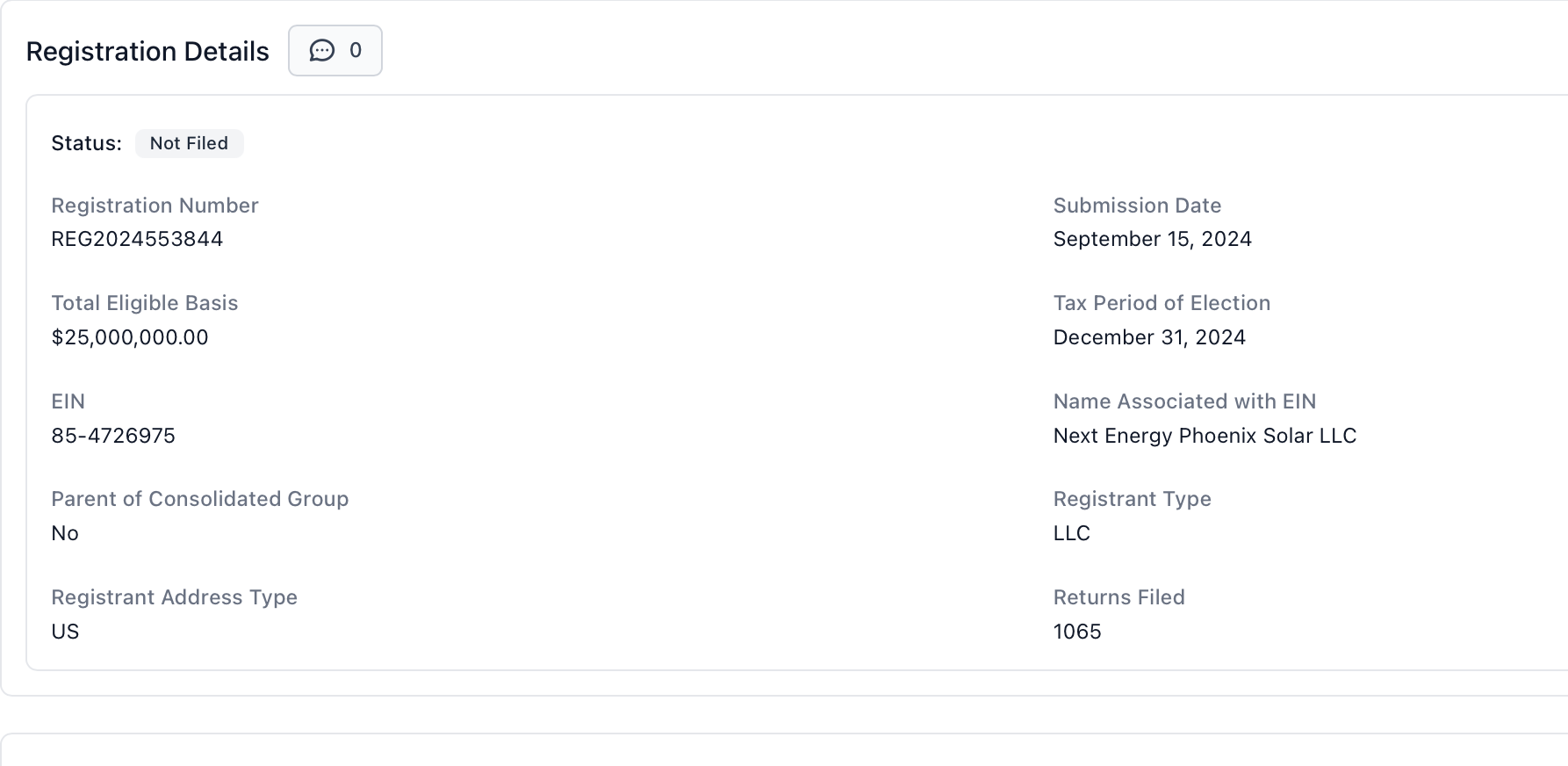

IRS Registration Tracking

Complete IRS form tracking

Track all registration numbers and submission dates

Deadline management

Never miss important filing deadlines

Registration status monitoring

Real-time updates on registration status

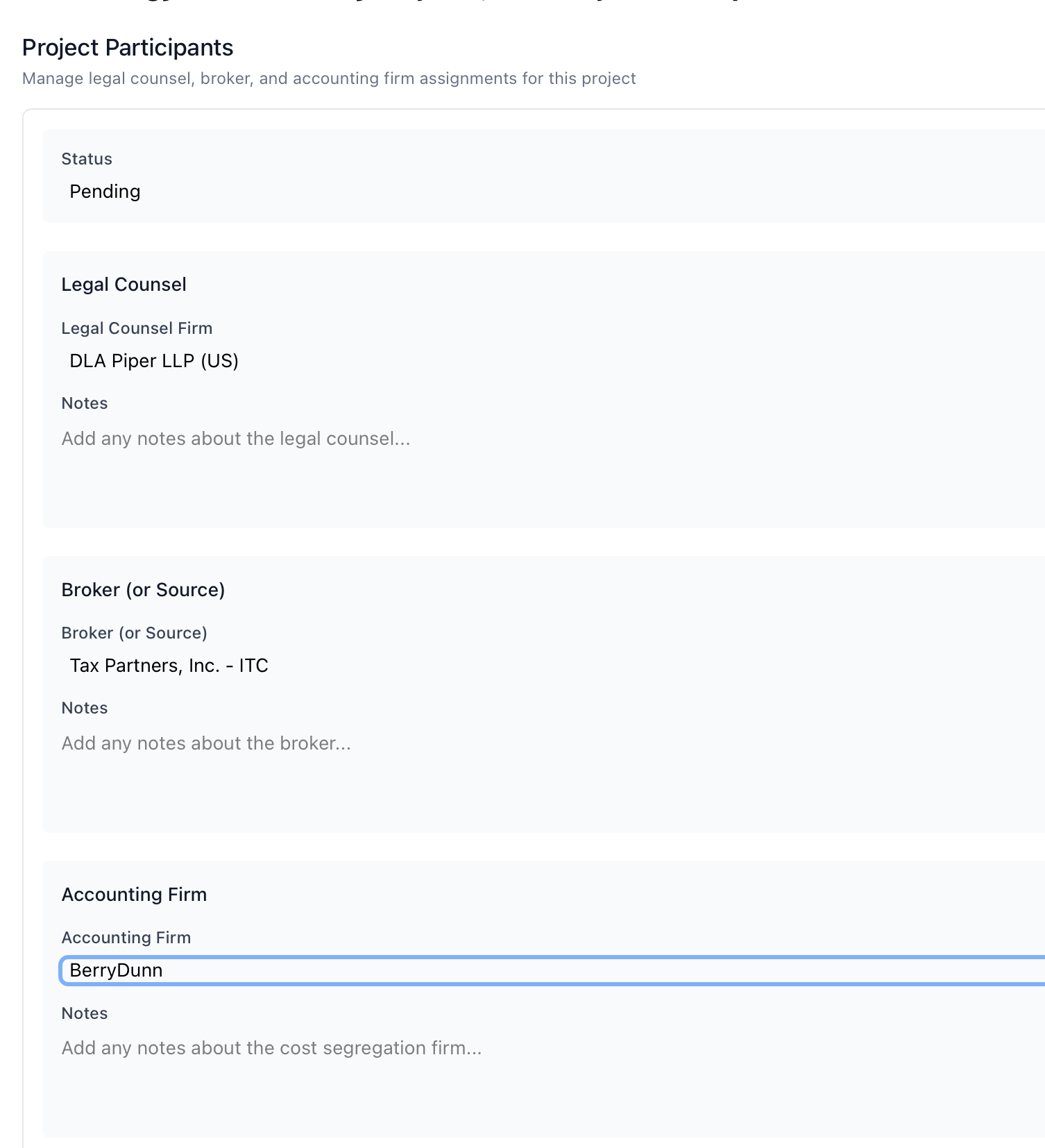

Project Participant Coordination

Centralized stakeholder directory

Manage all participants in one place

Role-based access control

Secure permissions for each stakeholder

Team collaboration tools

Real-time communication and updates

Domestic Content Certification

Automated compliance checking

Verify domestic content requirements automatically

Document verification tools

Track steel/iron and manufactured product percentages

Bonus credit calculation

Calculate eligible bonus credits automatically

Insurance & Risk Management

Policy tracking and management

Centralize all insurance policies in one place

Coverage verification

Verify coverage amounts and policy details

Expiration alerts

Get notified before policies expire

Risk Management for Buyers, Opportunities for Builders

The Inflation Reduction Act created enormous opportunities, but also complex challenges that traditional systems cannot handle.

For Credit Creators & Partners

Overwhelming Documentation

Preparing tax credit packages requires hundreds of documents across dozens of categories, with different requirements for each credit type.

Legal Complexity

Expensive attorney-driven due diligence processes create bottlenecks, with legal fees often consuming significant credit value.

Value Leakage

Inconsistent documentation and compliance uncertainty lead to discounted pricing from buyers, reducing the realized value of credits.

For Credit Filers & Acquirers

Inconsistent Documentation

Every project has unique documentation structures, making evaluation time-consuming and creating significant staffing challenges.

Compliance Uncertainty

Regulations evolving faster than internal policies can adapt, creating gaps between IRS requirements and organizational processes.

Resource Bottlenecks

Limited specialized staff creates delays in credit evaluation, reducing the organization's ability to capitalize on market opportunities.

Complex Financial Instruments Require Specialized Solutions

Tax credits involve intricate IRS regulations that vary by credit type, project characteristics, and timing.

Documentation requirements are extensive and must satisfy both legal and accounting standards.

Transfer mechanics under Section 6418 introduce new compliance considerations for all parties.

Audit risk requires comprehensive record-keeping that traditional systems cannot efficiently provide.

Let's solve your tax credit challenges together

Fill out this short form to connect with a Deal Star tax credit specialist.

You can expect the following once you submit:

- • We'll review your business needs.

- • One of our specialists will contact you to discuss tailored solutions.

- • You'll get insights into how Deal Star can help streamline your compliance.

Connect with us now — we're excited to speak with you!

Already a customer? Get technical support.