Due Diligence Automation

Eliminate manual review bottlenecks and human error with intelligent document analysis and automated verification workflows

Accelerate Your Due Diligence Process

Our platform provides comprehensive automation tools that streamline the tax credit due diligence process, reducing time and costs while improving accuracy.

Automated extraction and analysis of key information from project documents

Pre-configured templates tailored to specific credit types and deal structures

Comprehensive dashboard for monitoring due diligence progress and identifying bottlenecks

Intelligent Document Processing

Our platform leverages advanced AI to automatically extract, organize, and analyze critical information from project documents

Automated Document Classification

Our AI automatically identifies and categorizes document types, eliminating manual sorting and organization.

- Recognizes 50+ document types

- Built specifically for Tax Credit Document types

- Handles multiple file formats

Data Extraction & Validation

Our platform automatically extracts key information from documents and validates it against expected values and formats.

- Extracts dates, amounts, entities

- Identifies inconsistencies

- Flags missing information

Compliance Verification

Our system automatically checks document contents against regulatory requirements and identifies potential issues.

- IRS compliant verification

- Tax credit regulation checks

- Regulatory update integration

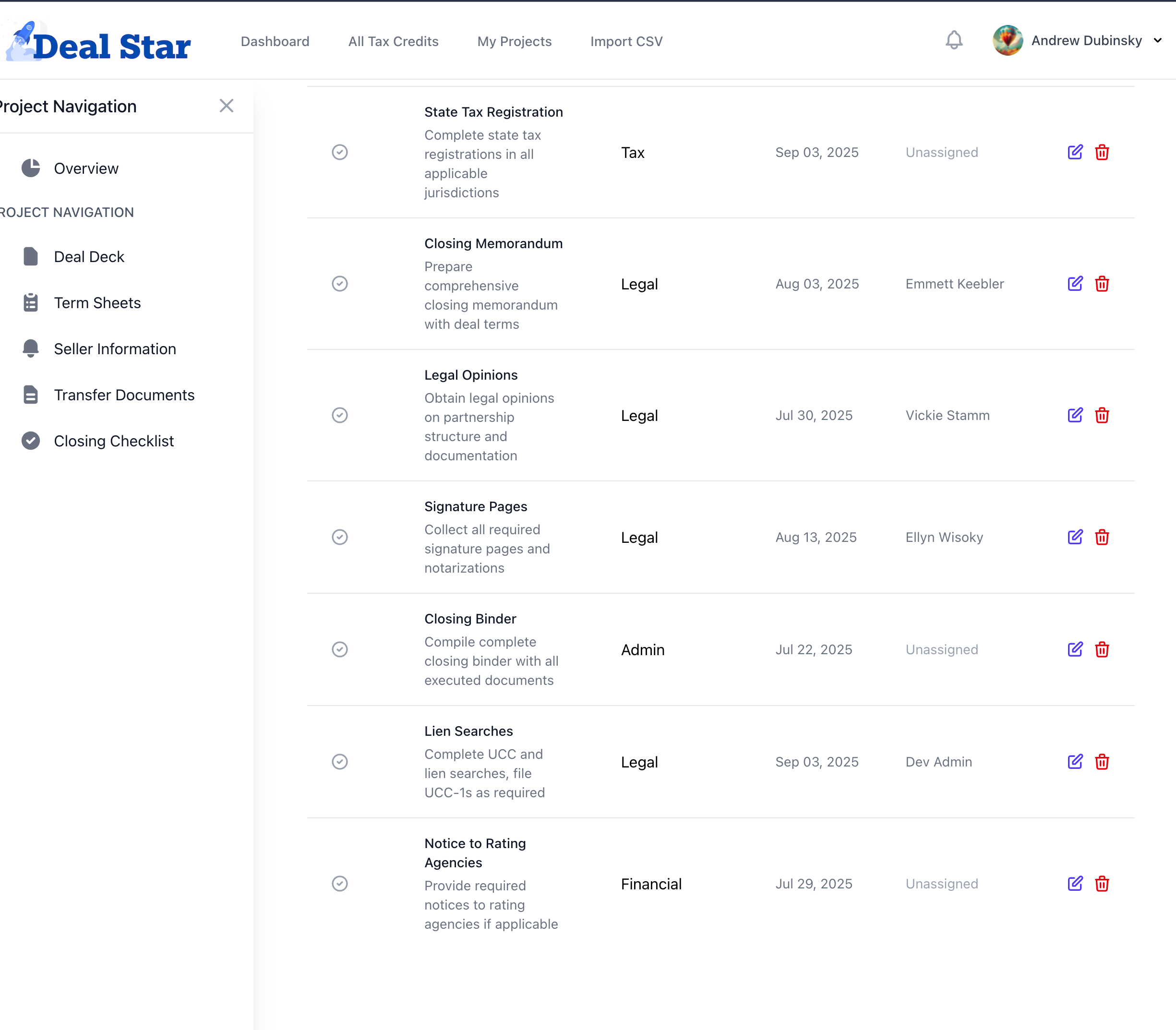

Customizable Workflow Management

Our platform provides configurable workflows that adapt to your specific due diligence processes and requirements.

Configurable Due Diligence Templates

Pre-built templates tailored to different credit types and project structures, customizable to your specific requirements.

Role-Based Assignments

Automated task assignment based on user roles and expertise, ensuring the right people handle the right aspects of due diligence.

Automated Notifications

Intelligent notification system that alerts team members about task assignments, approaching deadlines, and issues requiring attention.

Progress Tracking

Real-time visibility into due diligence progress, with customizable dashboards and reports to monitor status and identify bottlenecks.

Due Diligence Checklists

Comprehensive, customizable checklists that ensure thorough due diligence for every tax credit project

Tax Credit-Specific Requirements

Our platform provides customized checklists tailored to specific tax credit types and their unique requirements.

- ITC Section 48E (Solar) requirements

- PTC Section 45Y (Clean Electricity) requirements

- 45Q Carbon Capture requirements

- 30C EV Charging requirements

- 45V Clean Hydrogen requirements

Adder & Bonus Verification

Comprehensive verification of eligibility for tax credit adders and bonus rates.

- Domestic Content verification

- Energy Community qualification

- Low-Income Community Benefit

- Prevailing Wage & Apprenticeship

Placed in Service Verification

Comprehensive verification of placed in service requirements and documentation.

- Five-point framework validation covering construction, permits, legal, transfer, and grid synchronization

- AI-powered document classification for 15+ critical document types including IRS Form 3468 and PTO letters

- Automated December 31st deadline tracking with multi-stage verification workflow

Legal & Tax Opinion Integration

Seamless integration with legal and tax opinion processes and requirements.

- Legal opinion requirements tracking

- Tax opinion document preparation

- Template-based document generation

Collaborative Due Diligence

Our platform enables seamless collaboration between all stakeholders in the due diligence process.

Internal Team Collaboration

Streamlined collaboration between internal team members with real-time updates, shared comments, and task assignments.

External Advisor Integration

Secure collaboration with external legal, tax, and technical advisors, with controlled access to relevant documents and information.

Project Developer Portal

Dedicated portal for project developers to submit documentation and respond to information requests.

Comment & Annotation Tools

Advanced tools for commenting on documents and highlighting issues that need attention or clarification.

Ready to accelerate your due diligence process?

Our platform reduces due diligence time by up to 70% while improving accuracy and compliance

Schedule a Demo