Deal Star Platform Features

Comprehensive tax credit management platform with document intelligence and end-to-end project tracking

Project Management

Streamlined project lifecycle management with version control and collaborative tools.

Term Sheets

Data Captured: Pricing, terms, deal structure, counterparties

Status Tracking: Draft, term sheet submitted, approved, executed

Features: Version control, collaborative editing, approval workflows

Closing Checklists

Data Captured: Task assignments, completion status, due dates

Status Tracking: Not started, in progress, completed, blocked

Features: Real-time updates, file attachments, progress tracking

Marketing Materials

Data Captured: Project summaries, financial projections, marketing documents

Status Tracking: Draft, public, private, closing, sold

Features: Multi-tenant access control, document management

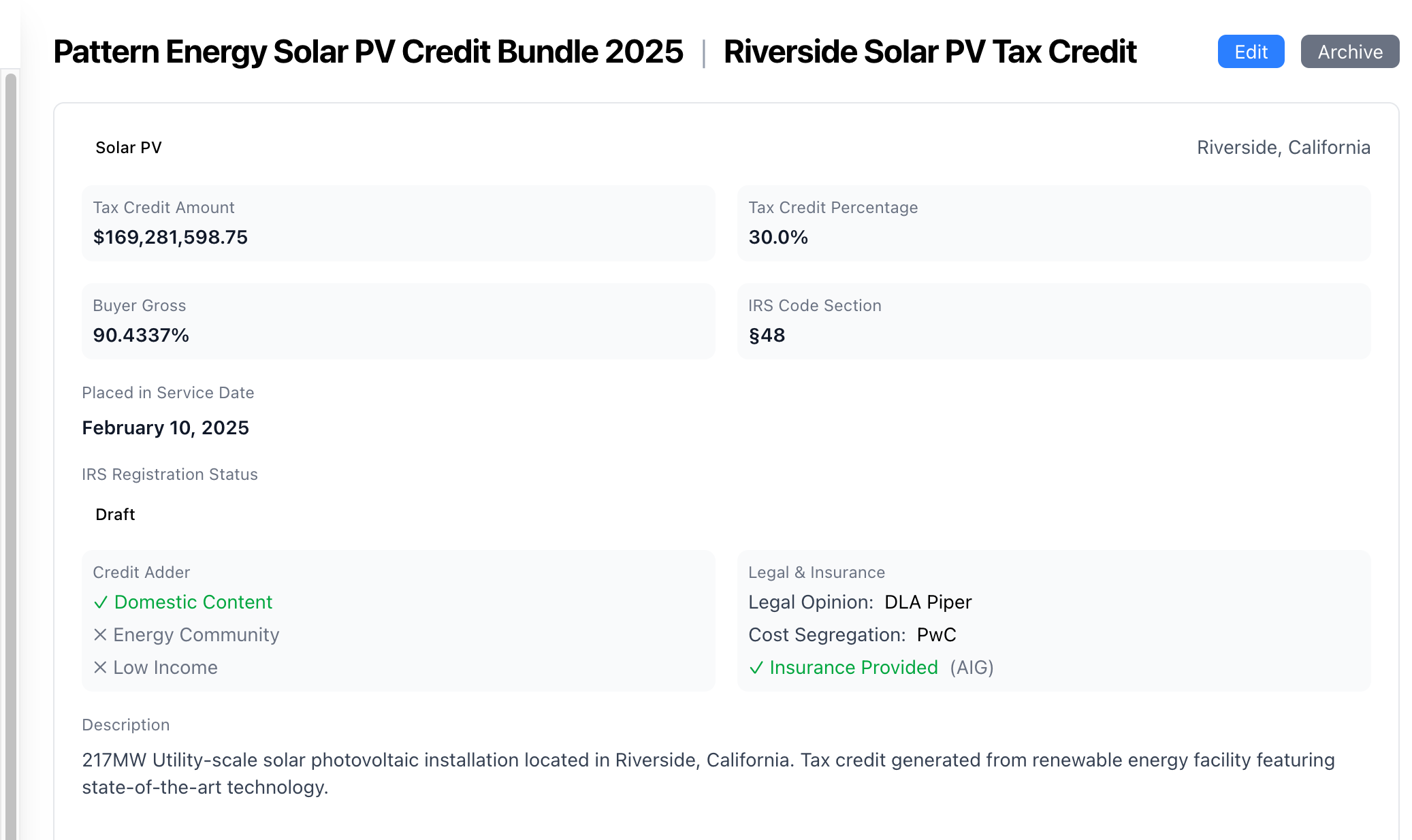

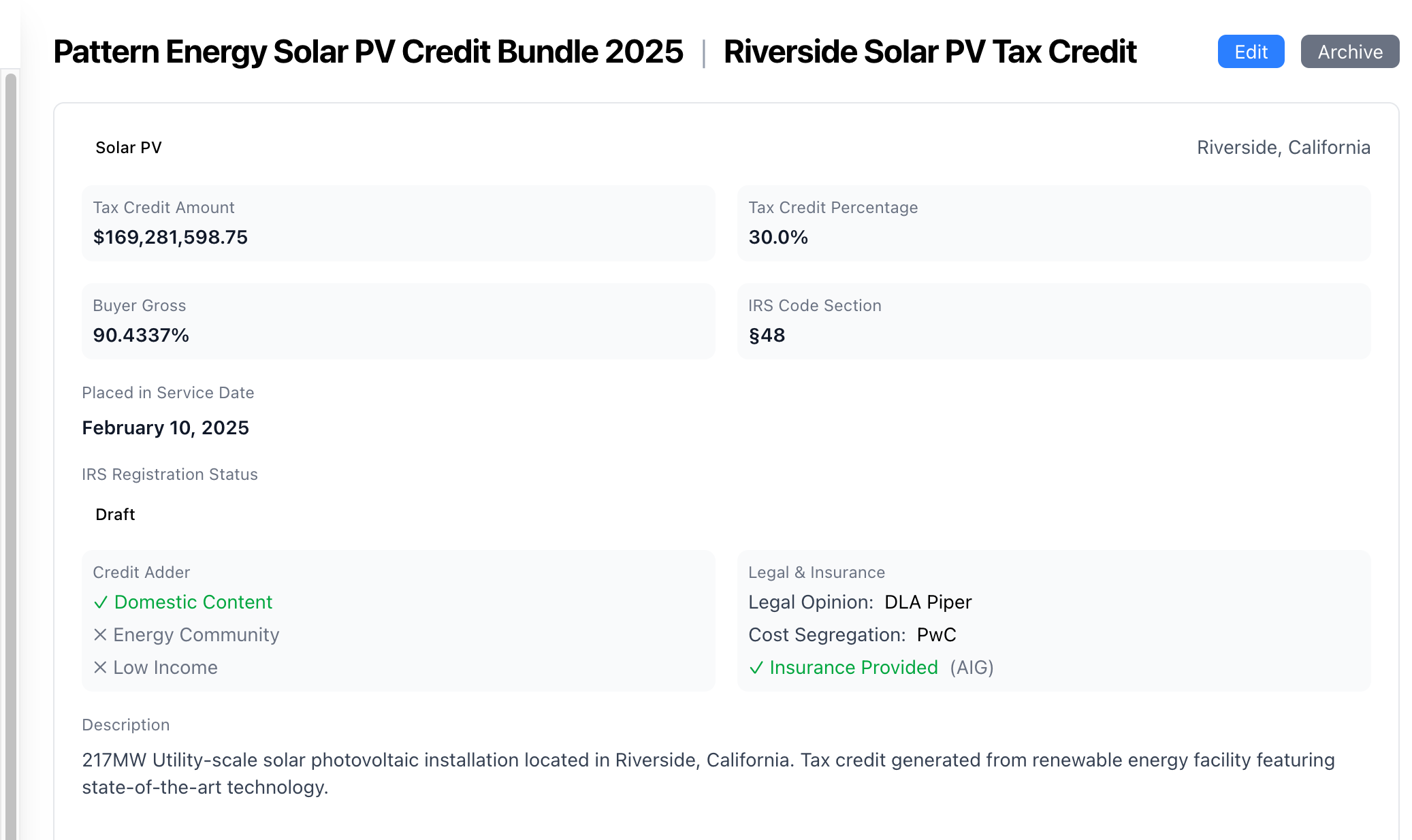

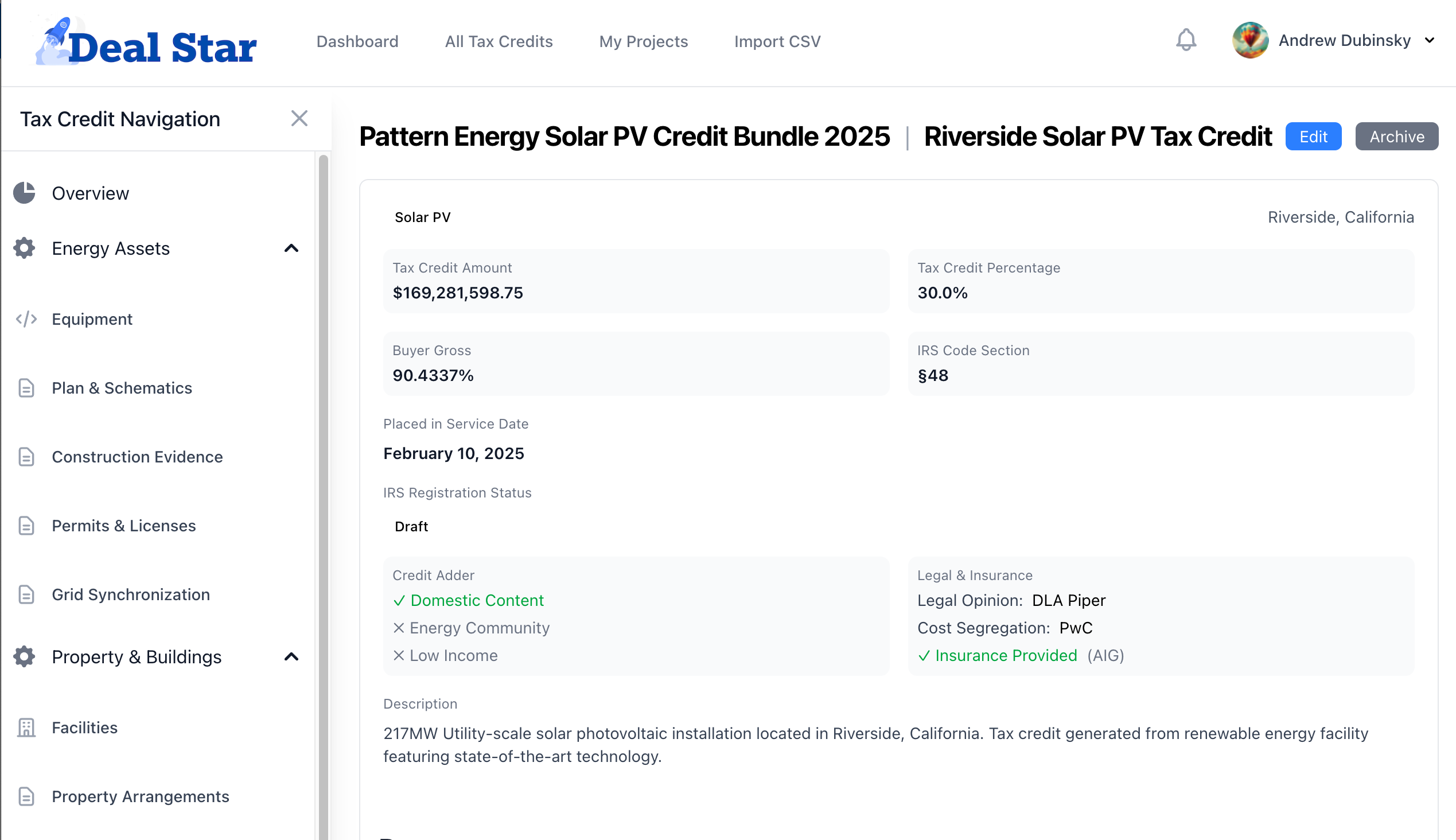

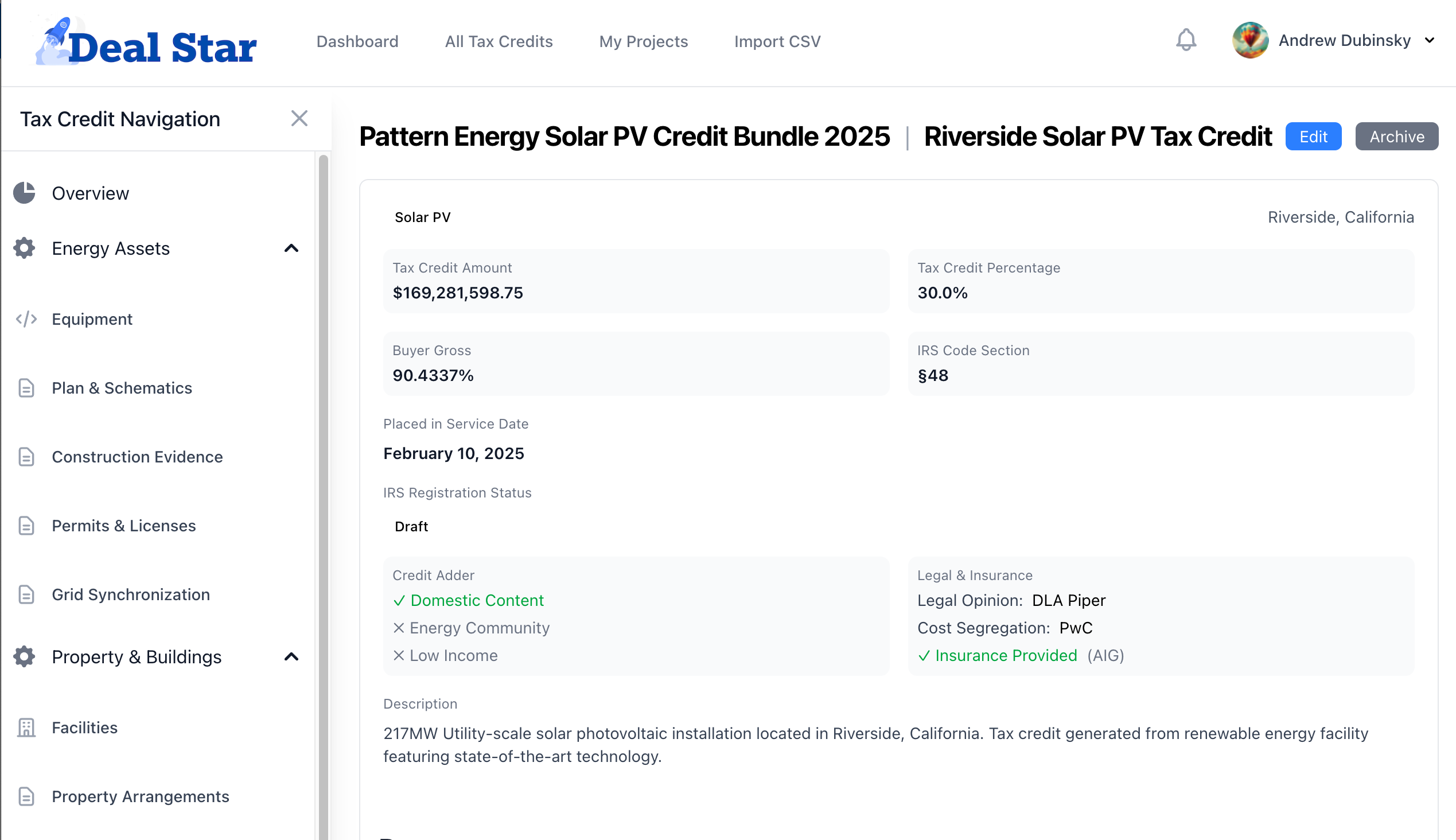

Tax Credit Management Hub

Comprehensive tax credit lifecycle management with detailed tracking across all IRS requirements

Energy Assets

Invoices, sales contracts, grid testing, PAN files, irradiance data, system design, CAD drawings, electrical schematics, O&M contracts

Construction photos, progress reports, completion certificates, commissioning reports

Building permits, electrical permits, interconnection agreements, regulatory approvals

Interconnection studies, PTO letters, grid testing results, commissioning reports

Property & Buildings

Facility documentation, property descriptions, building specifications, site layouts

Land leases, easements, purchase agreements, title documents, survey reports

Access agreements, road easements, construction permits, security arrangements

EPC contracts, site preparation agreements, utility contracts, maintenance agreements

Financial Models

PPAs, hedge agreements, revenue contracts, pricing structures

Third-party appraisals, valuation reports, market analysis, fair value assessments

Equipment costs, installation costs, soft costs, financing costs, total project costs

Component-level cost analysis, depreciation schedules, tax optimization studies

Energy Percentage (Adders)

Wage documentation, certified payroll, apprenticeship compliance, DOL classifications

Component sourcing, manufacturing certificates, domestic content calculations, supply chain documentation

Location verification, census tract analysis, economic impact studies, qualification documentation

Community qualification, benefit analysis, environmental justice documentation, HUD mapping

Transferability

Pre-registration filings, transfer elections, IRS notifications, compliance tracking

Purchase agreements, transfer forms, tax elections, closing documents

Supporting documentation, supplementary filings, compliance certificates

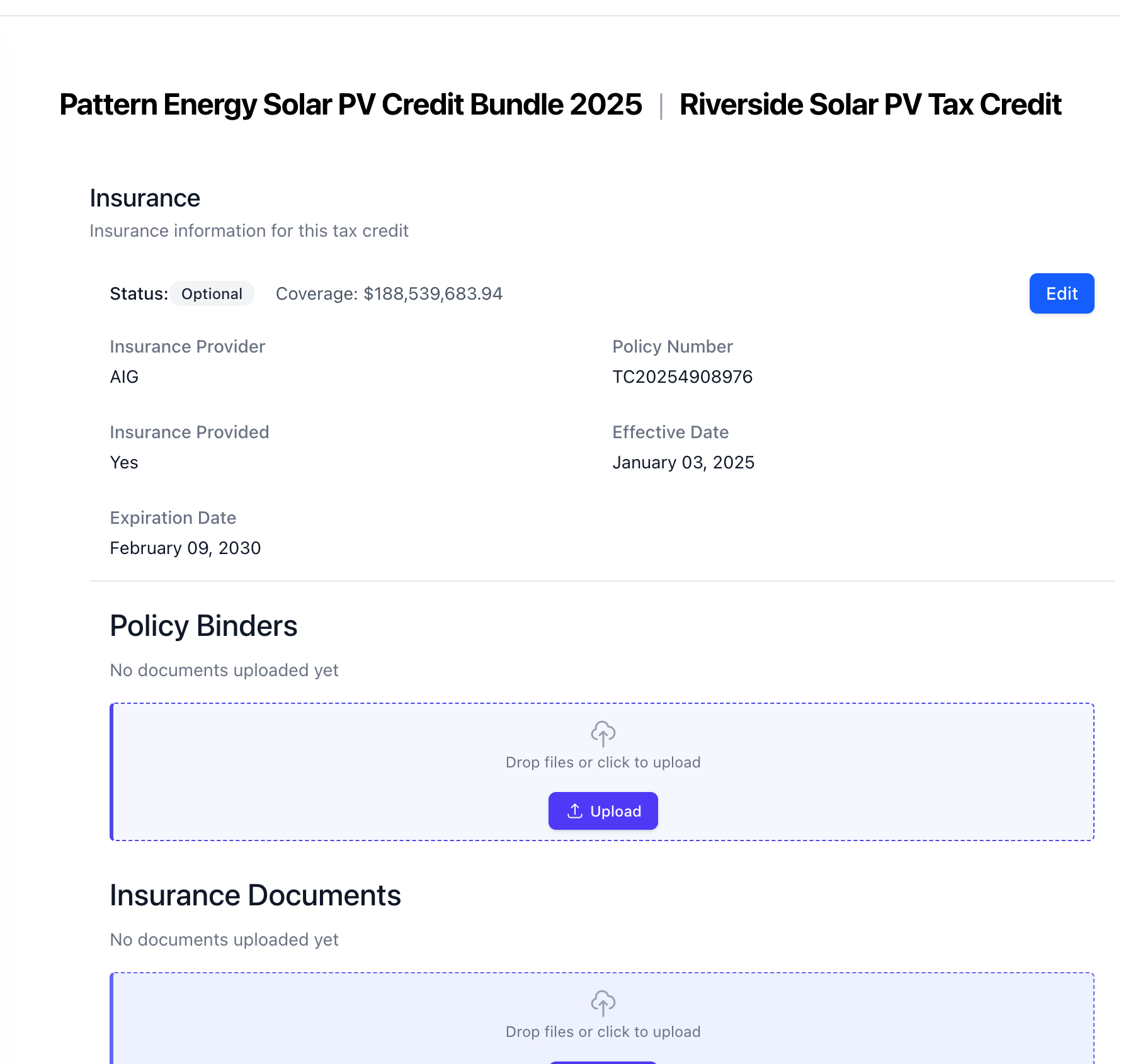

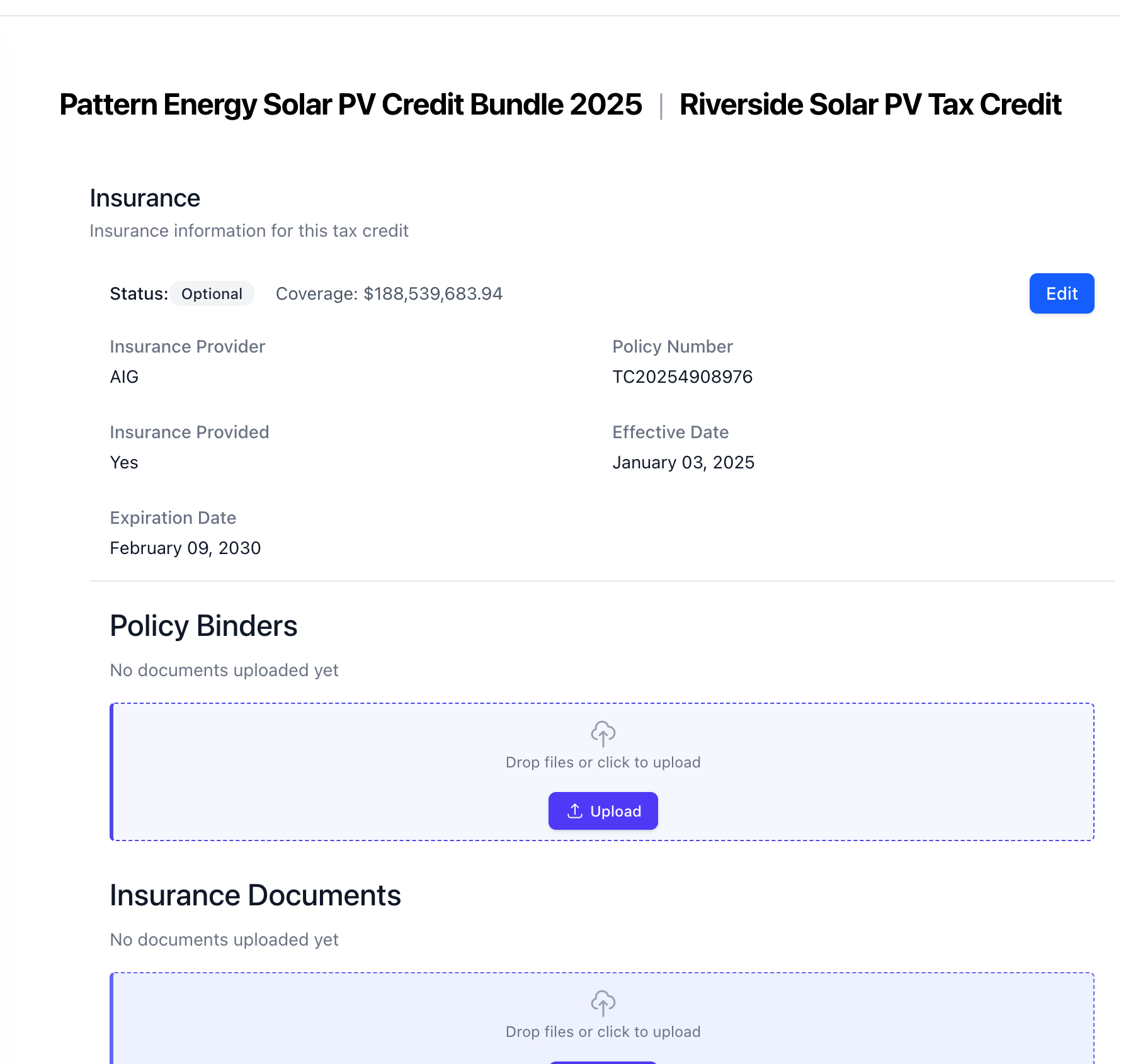

Financial Surety

Coverage policies, certificates, claims history, risk assessments, premium documentation

Financial statements, credit ratings, guarantee agreements, performance bonds

Tax opinions, legal memoranda, compliance reviews, regulatory analysis

Document Intelligence

AI-powered document processing for tax credit documentation management.

Automated Document Classification

Document Types: 50+ categories including invoices, contracts, permits, certificates, appraisals

File Support: PDF, DWG, DXF, DOC, DOCX, XLS, XLSX, PAN files

Processing: Automatic classification and routing to appropriate sections

Intelligent Data Extraction

OCR Technology: Advanced text recognition and data extraction

Field Mapping: Automatic population of form fields from documents

Validation: Cross-reference verification and consistency checks

Document Verification

Status Tracking: Pending, verified, requires attention, approved

Audit Trail: Version control and change tracking with PaperTrail

Compliance: Automated compliance checks against IRS requirements

Status Tracking & Workflow

Comprehensive status management and workflow automation across all project components.

Tax Credit Status Management

Overall Status: Draft, pending, approved, rejected, expired

Visibility Status: Draft, public, private, closing, sold

Placed-in-Service: 5-point verification checklist with completion tracking

Component-Level Tracking

Equipment Status: Invoice verification, installation confirmation, testing completion

Property Status: Title verification, permit approval, access confirmed

Financial Status: Appraisal complete, cost basis verified, funding confirmed

Approval Workflows

Multi-Level Approval: Automated routing based on project value and complexity

Real-Time Updates: Instant notifications via Turbo streams

Audit Trail: Complete history of all status changes and approvals

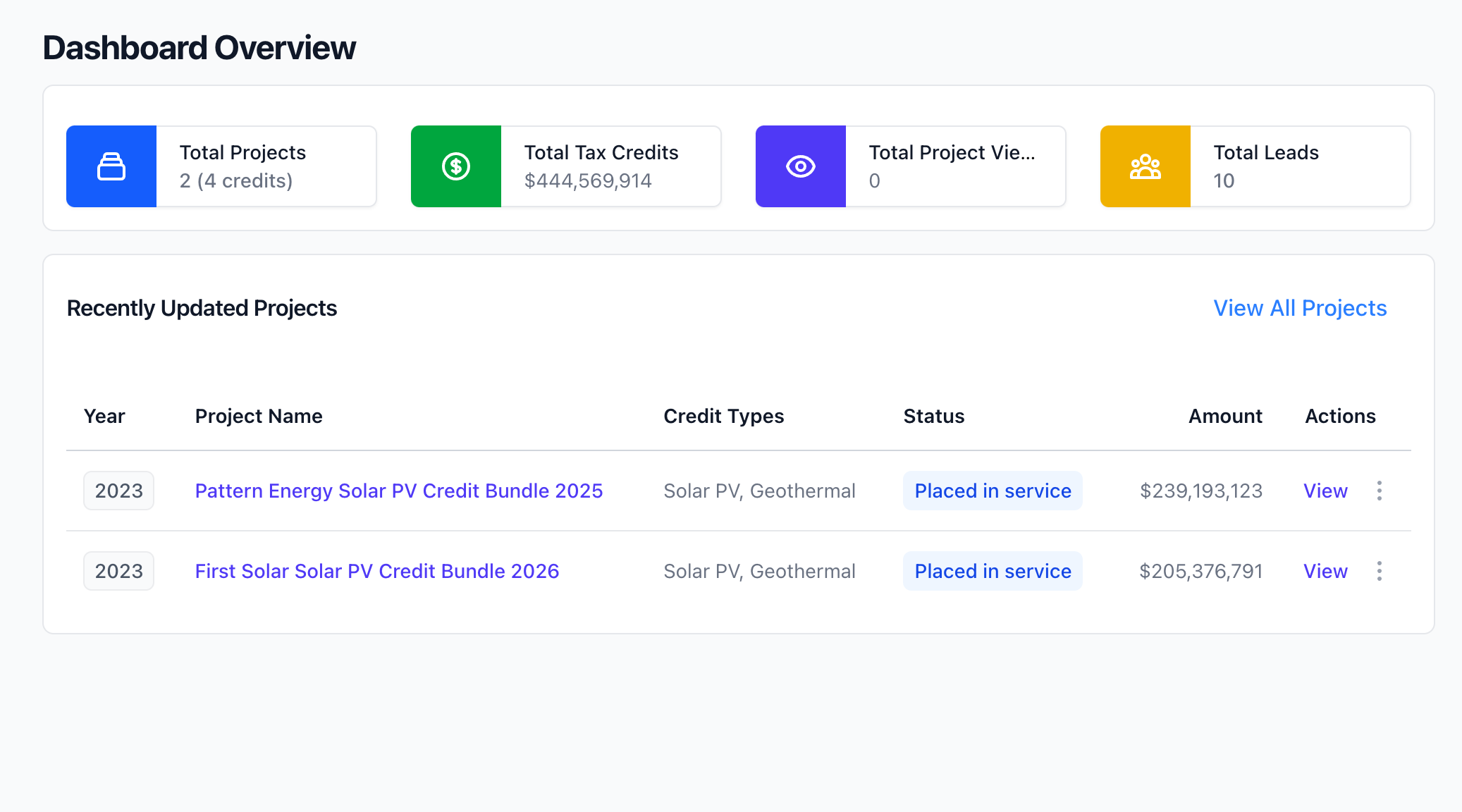

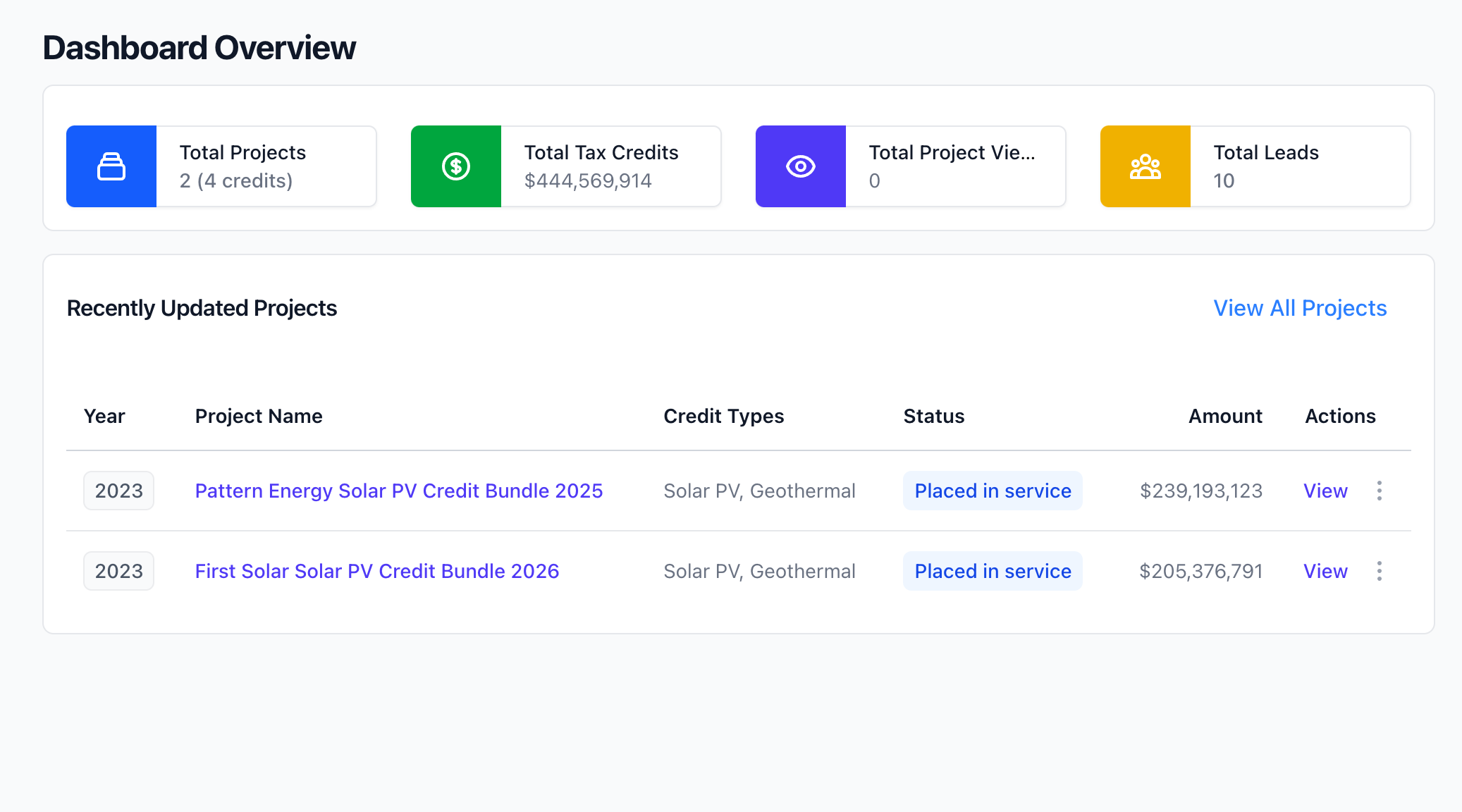

Dashboard & Analytics

Comprehensive project and tax credit analytics with real-time performance tracking.

Project Metrics

Portfolio View: Total projects, active tax credits, total credit amounts

Performance Tracking: Project views, lead generation, conversion rates

Financial Summary: Total value, average project size, revenue pipeline

Advanced Filtering

Multi-Criteria Search: Year, construction status, credit type, location

Financial Filters: Credit amount ranges, project value, pricing tiers

Status Filters: Viewable status, completion status, approval status

Activity Monitoring

Real-Time Updates: Recent activity feeds, status changes, document uploads

Notifications: Automated alerts for critical milestones and deadlines

Reporting: Exportable reports and analytics dashboards

User Management & Security

Enterprise-grade security and user management with multi-tenant architecture

Multi-Tenant Architecture

Complete account separation with secure data isolation between organizations.

- Account-based isolation

- Secure data separation

- Account switching

Role-Based Permissions

Granular access control with role-based authorization using Pundit policies.

- User role management

- Access control policies

- User invitations

API & Integration

RESTful API with secure authentication and data import/export capabilities.

- API token management

- CSV import/export

- Webhook support

Ready to streamline your tax credit management?

Experience our comprehensive platform designed specifically for renewable energy tax credit professionals

Request a Demo